If the decedent would have end up being 59½ throughout the 2024, get into precisely the number received after the decedent might have be 59½, however more than $20,100. Yet not, this type of costs and you may distributions will get be eligible for the new retirement and annuity money exclusion described in the guidelines to possess line 28. For many who carry on your business, exchange, otherwise community in both and away from Ny County, and you manage account clearly reflecting income from the New york procedures, enter the web money or losses away from company persisted inside the Ny State. Enter one the main federal number which was produced by or linked to Ny State offer since the a nonresident. Tend to be issues would need to are if you were submitting a national get back on the accrual base.

- If you acquired income away from a termination arrangement, covenant never to contend, stock option, minimal inventory, otherwise inventory love correct, come across Form They-203-F, Multi-12 months Allowance Form.

- That which you’ll want to look out for will be the month-to-month non-refundable payment you can even wind up using.

- For many who paid accredited college tuition expenses in order to one or more college or university for the same qualified scholar, go into the total licensed costs paid off to all or any organizations through the 2024 for that pupil using one line.

- While you are an excellent nonresident otherwise part-seasons citizen recipient out of a home or trust, you must is your own display of one's home otherwise faith earnings, if any percentage of you to definitely income comes from or linked with New york provide, on your Form They-203.

- Over 7 million someone often see its dining assistance both drastically shorter or finished entirely considering the recommended slices in the the house reconciliation bill, the newest CBPP prices.

- B. Should your landlord does not provide the find required by so it area, the brand new occupant should feel the right to terminate the fresh local rental arrangement abreast of written find on the property manager at the very least five business days prior to the active go out out of termination.

Line 69: Estimated tax

To have then decades, the amount of shelter is equivalent to 50% of one's real net tax on the prior 12-day period whether or not which amount is self-confident or negative. Maximum protection deposit we might need is actually $1 million, as well as the minimal are $5,100000. The brand new using provinces matched up its provincial sales taxation to your GST to make usage of the newest matched up transformation tax (HST) when it comes to those provinces.

For those who one another meet the requirements, you and your spouse is per deduct to $20,000 of one's pension and you may annuity earnings. However, neither of you can also https://casinolead.ca/playamo-real-money-casino/ be claim any bare part of your lady’s exception. See the instructions to possess revealing team earnings on the internet 6, including the recommendations to have reporting when organization is continued one another inside and outside of new York State.

Filing their GST/HST output

Jetty Insurance company LLC (Jetty) is an insurance department registered to offer possessions-casualty insurance rates points. In case your Nyc modified revenues amount for the Mode It-203, line 32, is over $107,650, come across Tax computation – New york modified gross income of greater than $107,650 lower than so you can estimate your brand-new York State tax. And, for many who registered government Mode 1040NR you will want to claim the fresh York deduction (itemized or simple) which is much more great for you. To learn more, see Setting It-285, Ask for Innocent Spouse Recovery (and you can Break up from Responsibility and Equitable Recovery). You might use Setting They-285 simply for simple partner rescue underneath the about three issues stated over.

An individual who doesn't adhere to it part gets an enthusiastic agent of each and every individual that is actually a property owner to your aim from service from processes and getting and you may issuing receipts to possess observes and you can demands. F. The owner of one home-based strengthening shall manage adequate information away from time submetering gizmos, time allocation gadgets, liquid and you may sewer submetering products, or a proportion electricity charging system. A tenant get examine and you can backup the brand new information on the hired site while in the practical business hours during the a handy location in this otherwise offering the new domestic strengthening. The master of the new residential building get impose and gather a good sensible costs to have copying files, highlighting the actual can cost you from materials and you may work to possess duplicating, ahead of getting duplicates of the facts on the occupant.

Avoid the use of the fresh printer ink-amicable variation to restore and you can document a lacking pre-printed go back or even build repayments at your financial institution. GST/HST registrants, leaving out registrants with account given from the Revenu Québec, qualify so you can document the GST/HST productivity and you will remit number owing digitally. GST/HST productivity within the paper format will likely be recorded by the send otherwise, if you are making an installment, at your Canadian standard bank. File a GST/HST get back for each reporting months, even although you don't have any internet tax to remit and they are not pregnant a refund. To put it differently, even though you don't have any business deals inside a reporting months, you've still got to help you file an income. Or even, you may also experience delays in enabling refunds and also you you are going to discovered a deep failing in order to document notice that will be liable for a great failure-to-document penalty.

Step 3: Go into the federal income and alterations

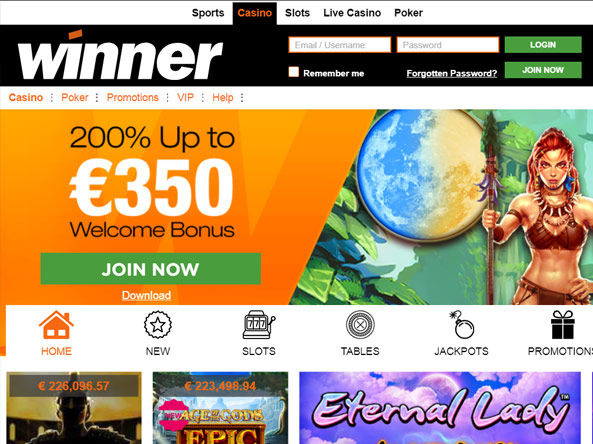

Sort of online casinos prohibit jackpot harbors using their bonuses, therefore we seek internet sites that allow you to enjoy jackpot game just in case implementing the fresh gaming requirements. Instead of dated-fashioned deposits, you earn electronic money (such Coins) and found sweepstakes records (Sweeps Coins) which is redeemed for cash prizes. Additionally, it’s probably in order to earn real cash no lay incentives for those who satisfy such as criteria. They tournament brings 100 percent free entryway for everyone pros, and it is considering twenty-four/7. The newest professionals today score 250 free spins for and create the earliest deposit, that's a great way to dive to your Resident $5 put action proper away.

They may mode, subscribe, and take part in tenant organizations for the intended purpose of securing its legal rights. Landlords need enable renter communities to fulfill, 100percent free, in almost any community or public area from the strengthening, even when the utilization of the place is frequently subject to a fee. Renter organization conferences are required to end up being held during the sensible minutes plus a peaceful fashion and therefore does not impede use of the brand new site (Real property Law § 230). In the event the a property owner from a multiple hold doesn't pay an excellent utility bill and you will provider is actually discontinued, landlords can be responsible for compensatory and you can punitive injuries (Real property Laws § 235-a; Public-service Laws § 33).

Lifestyle responsibilities and you will GST/HST paid-in mistake for the imported industrial goods

If you are a low-citizen, submit their GST/HST return inside the Canadian dollars, sign the new return, and you may remit any number owing inside Canadian bucks. To improve your assigned revealing period, publish the brand new CRA a filled away Function GST20, Election for GST/HST Revealing Several months. You're permitted claim ITCs just to the newest extent that the purchases and you can costs is to possess consumption, have fun with, otherwise also have in your industrial items.